UPDATE 21 Feb. 2024: The global EV battery market is a much bigger pie than it was just two or three years ago. In 2021, according to Statista, battery makers took in US $26 billion. By 2023, global EV battery revenues had mushroomed (according to a separate service, Markets and Markets) to $132.6 billion. It stands to reason that this was because of concomitant increases in EV production and sales. In 2021, 6.75 million battery-powered passenger cars, light trucks, and commercial vehicles were sold. For 2023, the world’s automakers sold 3.7 million in just the third quarter, on the way to a yearly total of 14 million vehicles in that category snatched up by environmentally-conscious consumers. These numbers don’t include the tens of millions of compact EVs such as e-bikes and electric scooters.

Along with that eye-popping growth in demand for electric vehicles have come dramatic changes in companies’ market share. When IEEE Spectrum provided a snapshot of the world’s leading EV battery makers in 2021, China’s Contemporary Amperex Technology Co. (CATL) and South Korea’s LG Energy Solution were industry’s twin titans, each boasting a 26 percent market share. CATL is now the big brother; in 2023, it gobbled up more than one-third of the market (37.4 percent), while LG’s market presence slipped to 14 percent. Chinese battery maker BYD, which supplies batteries for Ford’s EVs as well as its own line of electric vehicles, was in a fourth-place tie with Samsung SDI in the mid-2021 ranking. But BYD has cut itself a bigger slice, raising its market share from 7 to 15.7 percent. BYD now occupies the second-place slot after leapfrogging both Panasonic and LG. Panasonic, once the sole provider of batteries for Tesla, has seen its EV battery market presence cut nearly in half (from 17 percent to 10 percent) as competitors such as CATL took bites out of its Tesla-centric revenue stream.—IEEE Spectrum

Original article from 25 August 2021 follows:

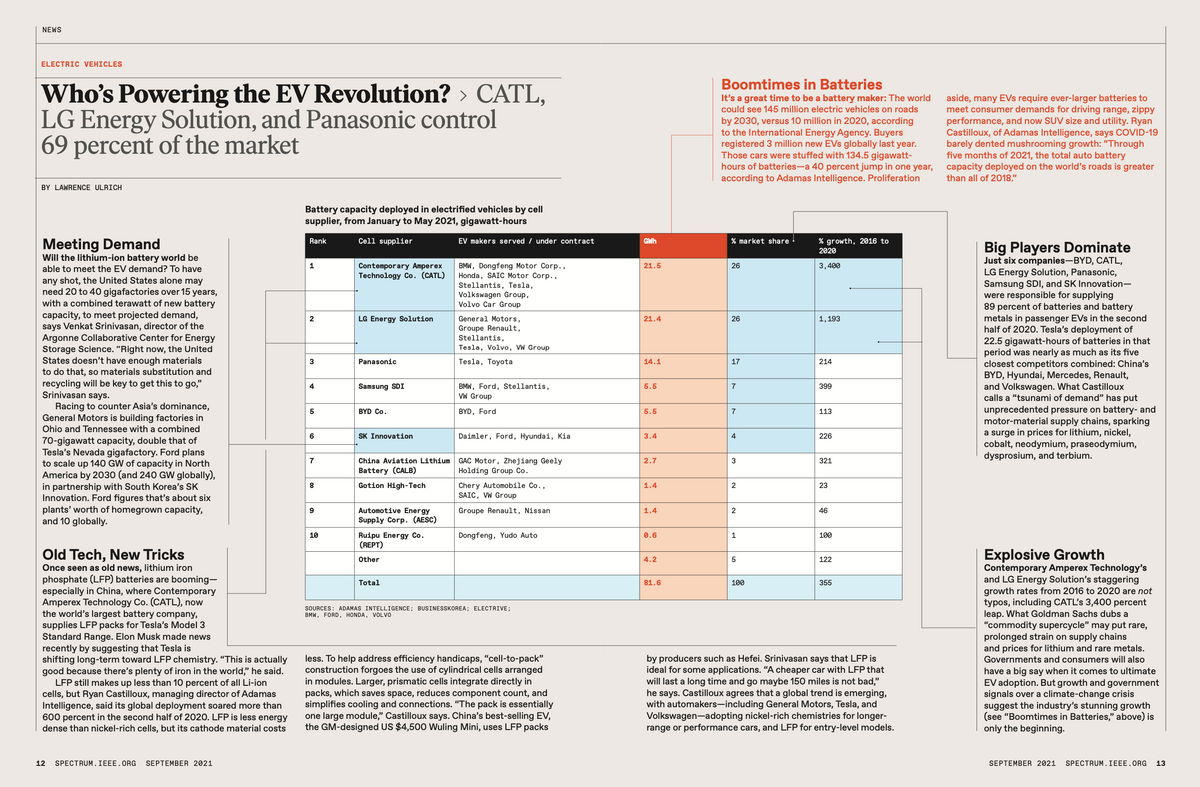

Boomtimes in Batteries

It’s a great time to be a battery maker: The world could see 145 million electric vehicles on roads by 2030, versus 10 million in 2020, according to the International Energy Agency. Buyers registered 3 million new EVs globally last year. Those cars were stuffed with 134.5 gigawatt-hours of batteries — a 40 percent jump in one year, according to Adamas Intelligence. Proliferation aside, many EVs require ever-larger batteries to meet consumer demands for driving range, zippy performance, and now SUV size and utility. Ryan Castilloux, managing director of Adamas Intelligence, says COVID-19 barely dented mushrooming growth: “Through five months of 2021, the total auto battery capacity deployed on the world’s roads is greater than all of 2018.”

- Contemporary Amperex Technology Co. (CATL)

EV makers served / under contract: BMW, Dongfeng Motor Corp., Honda, SAIC Motor Corp., Stellantis, Tesla, Volkswagen Group, Volvo Car Group

Stats: 21.6 GWh deployed (Jan.-May 2021) / 26% market share / 3,400% growth, 2016-’20 - LG Energy Solution

EV makers served / under contract: General Motors, Groupe Renault, Stellantis, Tesla, Volvo, VW Group

Stats: 21.4 GWh deployed (Jan.-May 2021) / 26% market share / 1,193% growth, 2016-’20 - Panasonic

EV makers served / under contract: Tesla, Toyota

Stats: 14.1 GWh deployed (Jan.-May 2021) / 17% market share / 214% growth, 2016-’20 - Samsung SDI

EV makers served / under contract: BMW, Ford, Stellantis, VW Group

Stats: 5.5 GWh deployed (Jan.-May 2021) / 7% market share / 399% growth, 2016-’20 - BYD Co.

EV makers served / under contract: BYD, Ford

Stats: 5.5 GWh deployed (Jan.-May 2021) / 7% market share / 113% growth, 2016-’20 - SK Innovation

EV makers served / under contract: Daimler, Ford, Hyundai, Kia

Stats: 3.4 GWh deployed (Jan.-May 2021) / 4% market share / 226% growth, 2016-’20 - China Aviation Lithium Battery (CALB)

EV makers served / under contract: GAC Motor, Zhejiang Geely Holding Group Co.

Stats: 2.7 GWh deployed (Jan.-May 2021) / 3% market share / 321% growth, 2016-’20 - Gotion High-Tech

EV makers served / under contract: Chery Automobile Co., SAIC, VW Group

Stats: 1.4 GWh deployed (Jan.-May 2021) / 2% market share / 23% growth, 2016-’20 - Automotive Energy Supply Corp. (AESC)

EV makers served / under contract: Groupe Renault, Nissan

Stats: 1.4 GWh deployed (Jan.-May 2021) / 2% market share / 46% growth, 2016-’20 - Ruipu Energy Co. (REPT)

EV makers served / under contract: Dongfeng, Yudo Auto

Stats: 0.6 GWh deployed (Jan.-May 2021) / 1% market share / 100% growth, 2016-’20

Sources: Adamas Intelligence, BusinessKorea, Electrive, BMW, Ford, Honda, Volvo

Big Players Dominate

Just six companies—BYD, CATL, LG Energy Solution, Panasonic, Samsung SDI, and SK Innovation—were responsible for supplying 87 percent of batteries and battery metals in passenger EVs in the second half of 2020. Tesla’s deployment of 22.5 gigawatt-hours of batteries in that period was nearly as much as its five closest competitors combined: China’s BYD, Hyundai, Mercedes, Renault, and Volkswagen. What Castilloux calls a “tsunami of demand” has put unprecedented pressure on battery- and motor-material supply chains, sparking a surge in prices for lithium, nickel, cobalt, neodymium, praseodymium, dysprosium, and terbium.

Meeting Demand

Will the EV battery world be able to meet the EV demand? To have any shot, the United States alone may need 20 to 40 gigafactories over 15 years, with a combined terawatt of new battery capacity, to meet projected demand, says Venkat Srinivasan, director of the Argonne Collaborative Center for Energy Storage Science. “Right now, the United States doesn’t have enough materials to do that, so materials substitution and recycling will be key to get this to go,” Srinivasan says.

Racing to counter Asia’s dominance, General Motors is building factories in Ohio and Tennessee with a combined 70-gigawatt capacity, double that of Tesla’s Nevada gigafactory. Ford plans to scale up 140 GW of capacity in North America by 2030 (and 240 GW globally), in partnership with South Korea’s SK Innovation. Ford figures that’s about six plants’ worth of homegrown capacity, and 10 globally.

Old Tech, New Tricks

Once seen as yesterday’s news, lithium iron phosphate (LFP) batteries are booming—especially in China, where Contemporary Amperex Technology Co. (CATL), now the world’s largest battery company, supplies LFP packs for Tesla’s Model 3 Standard Range. Elon Musk made news recently by suggesting that Tesla is making a long-term shift toward cheaper, zero-cobalt LFP. “This is actually good because there’s plenty of iron in the world,” he said.

LFP still makes up less than 10 percent of all Li-ion cells, but Castilloux said its global deployment soared more than 600 percent in the second half of 2020. LFP is less energy dense than nickel-rich cells, but its cathode material costs less. To help address efficiency handicaps, “cell-to-pack” construction forgoes the use of myriad cylindrical cells arranged in modules. Larger, prismatic cells integrate directly in packs, which saves space, reduces component count, and simplifies cooling and connections. “The pack is essentially one large module,” Castilloux says. China’s best-selling EV, the US $4,500 Wuling Mini, uses LFP packs by producers such as Hefei. Srinivasan says that LFP appears ideal for some applications. “A cheaper car with LFP that will last a long time and go maybe 150 miles is not bad,” he says. Castilloux agrees that a global trend is emerging, with automakers—including General Motors, Tesla, and Volkswagen—adopting nickel-rich chemistries for longer-range or performance cars, and LFP for entry-level models.

Explosive Growth

Contemporary Amperex Technology and LG Energy Solution’s staggering growth rates from 2016 to 2020 are not typos, including CATL’s 3,400 percent leap. What Goldman Sachs dubs a “commodity supercycle” may put rare, prolonged strain on supply chains and prices for lithium and rare metals. Governments and consumers will also have a big say when it comes to ultimate EV adoption. But growth and government signals over a climate-change crisis suggest the boomtimes in batteries (see “Boomtimes in Batteries”) are just beginning.

The Gold Standard, for Now

The race to boost battery nickel levels—and squeeze out pricey cobalt that’s often sourced in suspect conditions—has a leader in LG Energy Solution. The South Korean company’s potent NCMA cells (nickel, cobalt, magnesium, aluminum) will soon power Chinese-made Teslas and General Motors’ EV lineup, with an industry-best 88 percent nickel chemistry. Automakers adopting NCMA can stuff more energy and driving range into a given space, without major pack redesigns. Adamas Intelligence says that 60 percent of all passenger EV batteries deployed in 2020 featured high-nickel cells, such as NCA or NCM 6- to 8-series cells. For unproven NCMA tech, “China is the test ground and sandbox” before the cells trickle into Western markets, Castilloux says. SK Innovation—mimicking LG’s innovations, as usual—aims to put its NCMA cells into Fords. A small step below are NCM811 cells from players such as Contemporary Amperex Technology Co. (CATL), LG, and SK Innovation, with a roughly 8:1:1 ratio of nickel, cobalt, and manganese. One trick, Castilloux says, is to add nickel and curb cobalt while ensuring thermal stability, since fires are bad for business. Efficient manufacturing is another challenge, with CATL’s high-end cells currently showing dispiriting yields as the company ramps up production and processes. Currently, for every nickel-rich CATL cell produced, roughly one defective cell goes to the recycler, Castilloux says (that’s also bad for business). But with automakers eager to trumpet class-leading driving range or performance, advantages are clear: Battery cell densities have nearly tripled over the past decade, with leading chemistries now pushing past 300 watt-hours per kilogram.

This article appears in the September 2021 print issue as “Who’s Powering the EV Revolution?.” (A correction was made on 31 Aug 2021 — to reflect the fact that the top six EV battery makers account for 87 percent of the market, not 89 as was originally reported.)

- Honda Is Readying a Novel Battery Sharing Service for E-taxis in India ›

- Manganese Could Be the Secret Behind Truly Mass-Market EVs - IEEE Spectrum ›

- The EV Transition Explained: Battery Challenges - IEEE Spectrum ›

- The EV Battery Wish List - IEEE Spectrum ›

- BYD’s EV Dream May Be Legacy Automakers’ Nightmare - IEEE Spectrum ›

- Unico's Battery Testing Enters a Competitive Industry - IEEE Spectrum ›

Lawrence Ulrich is an award-winning auto writer and former chief auto critic at The New York Times and The Detroit Free Press.